Money worries play a significant part in the challenges many face today. Even for people usually “on top of their finances”, are now confronted with unprecedented uncertainty. So if you’re struggling with money right now, be certain you’re not alone.

How certain is your uncertainty though?

How much income do you have? What are your total outgoings? If you have to make cut-backs, where can they be made? What are your financial priorities?

It can help to understand the answers to these questions. Having them gives us a greater sense of control.

The good news is, now it is easy to monitor our finances. You don’t need to be a wizard with a spreadsheet, or use a complicated accounting system.

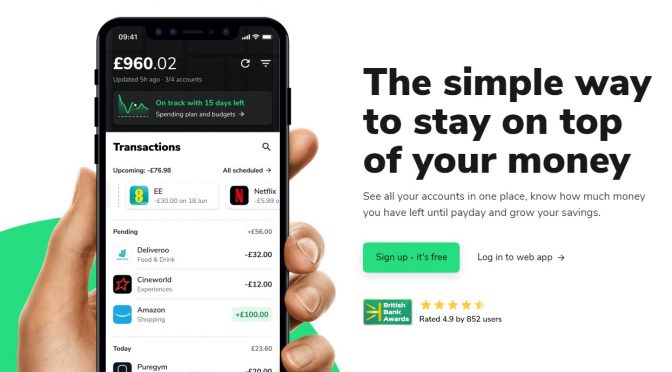

My personal favourite is a website called MoneyDashboard.com. It’s free and easy to use. You connect it to your bank account(s) and there you can:

- Track your bills

- Monitor your spending

- Forecast your balance(s)

There are two versions of Money Dashboard for you to choose from; Neon and Classic.

Neon is the newest addition, with a really easy interface and new features being added all the time. For me, I find the absence of a “Planner” feature limiting. It’s not so easy to forecast your bank balance. New features are being added all the time but for me it’s not ready for “Power users” yet. But if you’re using an app to manage your finances for the first time, it’s probably a place to go.

Classic, as the name suggestions, is the original Money Dashboard. I still use this because it has a comprehensive set of tools.

Note that both versions, although available through the same website, use different login details.

As MoneyDashboard is stored in the cloud, you can also access it via your iPhone or Android app seemlessly.

What I love is the low maintenance nature of this approach. No time stealing reconciliations to do. Just log in routinely to make sure your “Planner” is up-to-date and transactions are tagged appropriately.

I’ve tried many alternative financial apps but usually find myself coming back to this one.

What tools do you prefer to use to manage your finances? Let me know in the comments below!